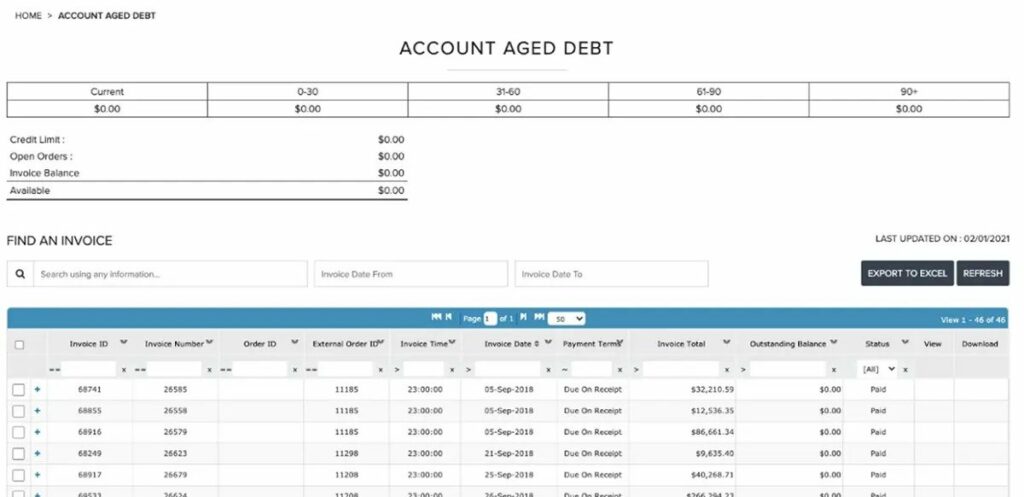

Inside your customers’ invoice payment portal, Cloudfy’s Aged Debt Management tool provides an accurate view of your B2B customers’ overdue payments. It shows the total amount of money owed, the average time it takes each of your customers to pay. And provides projections.

You can put credit rules in place for each customer, based on their payment history.

If they go over their limit, they won’t be able to use their ‘payment on account’ option.

Your customers will be able to check how much of their credit allowance they have used and get a clear view of their remaining credit limit.

If you’re in need of robust aged debt management tool to gauge your accounts receivables, contact us now to schedule your complimentary Cloudfy demo.